If you're working in Thailand, opening a bank account, applying for a credit card, or investing in stocks are essential considerations. Thailand has numerous banks, some of which are foreigner-friendly, while others can be more challenging to navigate. So, how do you choose the right Thai bank and open an account as an expat? Here, I’ll share my experience with Thai banks!

Table of Contents

How to Choose the Right Thai Bank as a Foreigner?

Different banks have varying policies and offerings, so it’s crucial for foreigners to do their research. My primary goal was to apply for a credit card, so I consulted with several banks. Some banks require foreigners to deposit a security amount equivalent to the credit card limit, which cannot be withdrawn during the card’s validity period, such as Bangkok bank.

Other banks, are more lenient, like Kbank. As long as you can provide proof of income from a Thai employer, they will generally approve your credit card application. Additionally, international transfer policies and fees vary widely between banks, so it’s worth comparing these details carefully.

The Process of Opening a Bank Account in Thailand

Opening a bank account in Thailand typically requires the following documents: (1)Passport, (2)Proof of address (e.g., a rental agreement or utility bill), (3)Work permit or proof of income (for certain banks). Some banks may also ask for additional documents, such as a reference letter from your employer or embassy. It’s best to call ahead and confirm the requirements with your chosen bank.

How to Apply for a Credit Card in Thailand

As mentioned earlier, the requirements for credit card applications vary by bank. Some banks may require a security deposit, while others only need proof of income.

In Thailand, banks generally require at leastsix months of salary proof and a work visabefore approving a credit card application.The evaluation process typically takes around 7 to 14 days..

Additionally, being polite to bank staff can increase your chances of approval.

Opening a Stock Trading Account in Thailand

Investing in stocks in Thailand is a whole different ball game. First, you’ll need to open an investment account.

The evaluation process for an investment account is even longer. The bank will assess your income, risk tolerance, and review all submitted documents. They will also call to verify your personal details and investment intentions. After this, the bank will take another 7 to 14 days to evaluate your application before notifying you of the outcome.

Once your investment account is set up, you can easily buy and sell stocks through a mobile app, making the process quick and convenient.

For expats working in Thailand with a steady income and a work visa, opening bank accounts and accessing various services is relatively straightforward. However, if you lose your expat status, reapplying for these services can be quite challenging. Therefore, if you have the opportunity to work in Thailand, it’s best to take care of all your banking needs early on and enjoy the convenience of Thailand’s financial services.

Can You Open a Thai Bank Account on a Tourist Visa? How to Open a Personal Account?

1. Why Would a Tourist on a Travel Visa Open a Thai Bank Account?

(A) Travel Convenience:During my time as an expat in Thailand, I often met friends from Taiwan who visited Thailand 2-3 times a year. For them, Thailand was like a second home. Many wanted to open a bank account because they traveled to Thailand so frequently for vacations or exhibitions. With the rise of electronic payments and mobile banking apps, having a Thai bank accountmakes travel much more convenient.For example, many street food vendors now accept QR code payments, reducing the need to carry large amounts of cash, which can be unsafe.

(B) Business and Reselling in Thailand:With the rise of Thai design and entertainment industries, many people are engaged inwholesale /resell of Thai products.. Frequently needing to make payments of varying amounts to Thai suppliers, having a Thai bank account makes transactions more convenient and efficient. Over time, this can save a significant amount on international transfer fees.

(C)Investment:In recent years, Thailand’s development has been impressive, attracting many people to invest in property here. Additionally, due to the slow economic growth in developed countries, some view Thailand as a profit gorwth boost for their funds. As discussed in several financial investment influencer, Thailand offers attractive investment opportunities.

Having a Thai bank account allows you to take advantage of favorable exchange rates and save money efficiently. Moreover, Thai banks offer higher interest rates compared to many developed countries, making it a good option for diversifying your savings. If you’re planning to retire or live in Thailand in the future, having a local account will make things much easier.

2. How to Open a Thai Bank Account with a Tourist Visa

Starting October 2025, tourist visa holders can no longer open Thai bank accounts.

Only the following three visa types are eligible:

1. Retirement Visa

2. Thailand Elite Visa

3. APEC Business Travel Card (ABTC)

(A) ❌ Using an Agent – No Longer Possible (from 2025)In the past, many people successfully opened Thai bank accounts using a tourist visa by hiring an agent. The cost for this service typically ranged from 20,000 to 35,000 THB. Starting in 2025, due to a rise in financing fraud, banks have tightened their review processes. Opening a Thai bank account now involves more complex documentation, and most agency fees have increased to 55,000–65,000 THB.

(B) ❌ Using Property Ownership Proof – No Longer Accepted (from 2025)

(C)❌ DIY Application – No Longer Allowed (since 2024)If you don’t use an agent or own property in Thailand, it was previously possible to try applying on your own by preparing the required documents. However, due to stricter regulations in recent years, it is no longer possible to open a Thai bank account with a tourist visa.

3. The Following Videos on Tourists Opening Thai Bank Accounts with a Tourist Visa Are Now Obsolete

(A) Kasikorn Bank in Phuket (No Longer Possible as of 2024)

(B) Bangkok Bank in Bangkok Downtown (No Longer Possible as of 2024)

(C) Bangkok Bank (No Longer Possible as of 2024)

4. Bank Announcement: Tourists Can No Longer Open Thai Bank Accounts with a Tourist Visa

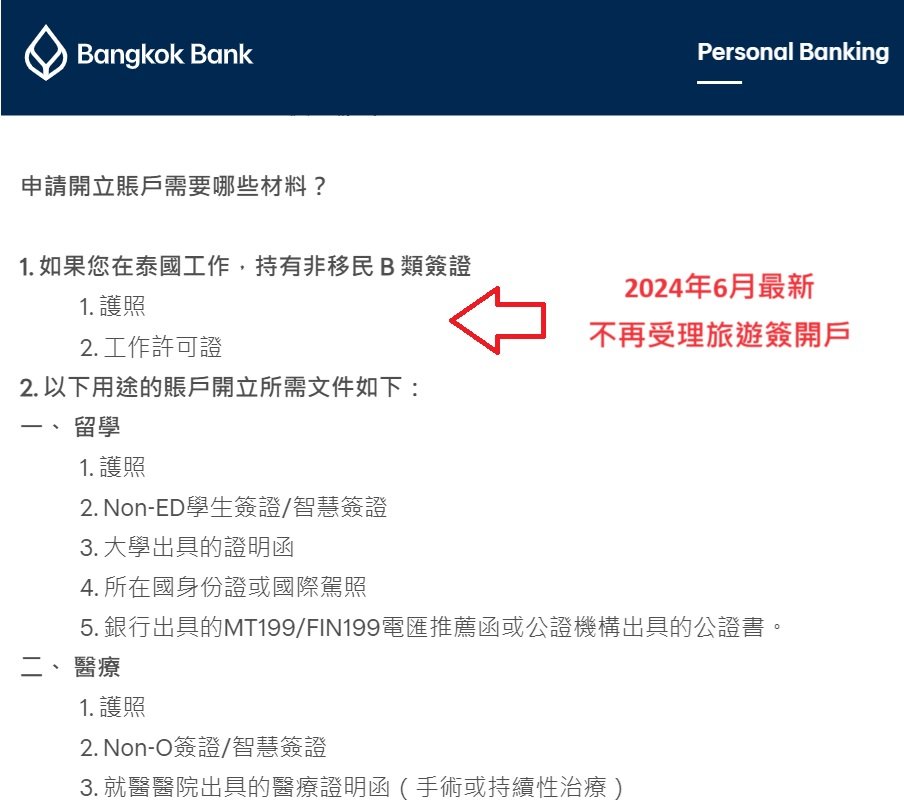

Latest Update (June 2024):Bangkok Bank has stopped accepting account applications from tourists on travel visas. According to the bank’s official page :click here

Under the "Opening a New Account" section

It is now indirectly refusing applications from tourists. Additional documents, such as a Thai driver’s license, are required. However, obtaining a Thai driver’s license typically requires at least a student or work visa.

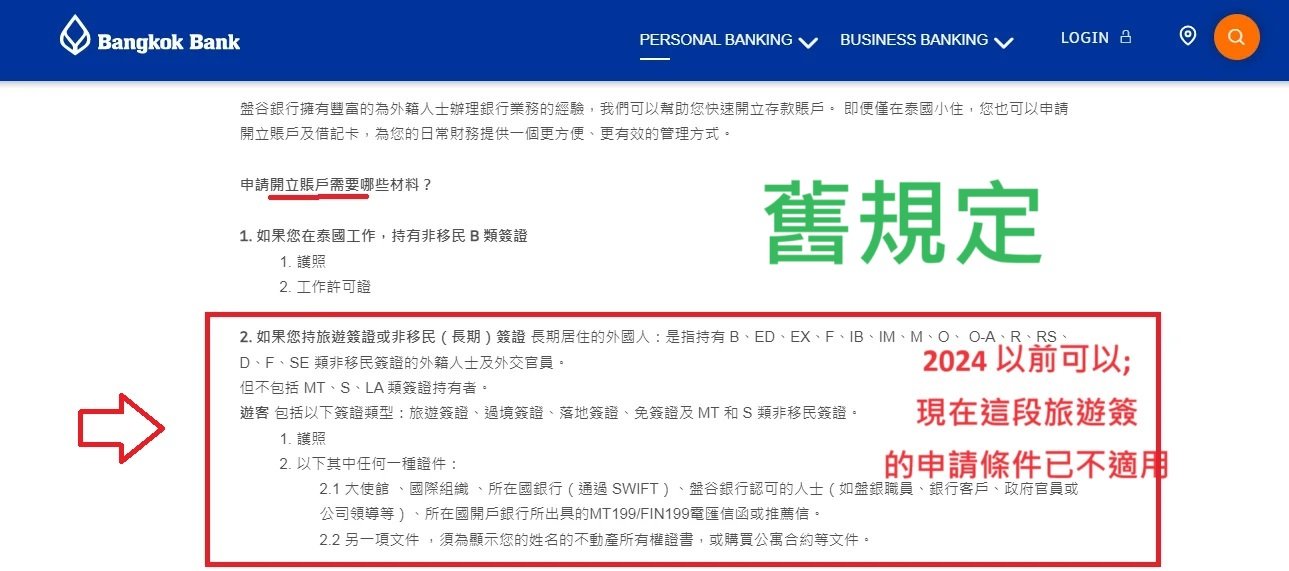

(Below is outdated information, no longer applicable)

Before 2024, the required documents for tourists to open a bank account with a Thai visa were as follows (see red box below):

(No Longer Possible as of 2024)

Frequently Asked Questions (FAQ) About Opening a Thai Bank Account

- Can you recommend a bank that makes it easier to open an account? Which Thai banks have staff who speak English?

The experience varies depending on the bank teller you encounter, as their acceptance of documents can be quite subjective. Based on past experiences, those of friends, the success rate of opening an account at Bangkok Bank’s headquarters was relatively high if you had all the required documents. However, now, without a long-term visa or property ownership, you will need to use an agent to open an account.

As for language, Thai bank tellers typically speak either Thai or English. It depends on the staff member you encounter during your visit.

-

Is opening an account not guaranteed? What are the conditions? I’ve looked up a lot of information online, but it seems like the rules keep changing.

As fraud cases increase, Thai banks have become much stricter with account opening requirements.

Each bank now reviews documents based on its own internal policy and list of accepted ID/Visas.

For example, Bangkok Bank used to allow account openings under a tourist visa (as stated on its website), but that notice was removed in 2024.

Whether you can successfully open an account depends largely on the branch’s discretion and how they verify your documents.

👉 Tip: Always check the latest requirements on the official sites of each bank before applying, to avoid outdated or incorrect information.

-

Do I need a Thai phone number to open a Thai bank account? How do I get a Thai SIM card? I want to open a Shopee Thailand store, so I need a Thai bank account and a Thai phone number.

Yes, opening a Thai bank account requires a Thai phone number, as the mobile banking apps are tied to a local number.

For long-term postpaid phone plans in Thailand, you usually need a work permit or student visa. However, if you’re on a tourist visa, you can opt for a short-term prepaid SIM card.These can be used long-term as long as you regularly top up the balance.(If the data runs out, it will automatically deduct funds for another month. If there’s no balance, you won’t have internet access but can still make calls and receive SMS verification codes.) These prepaid SIM cards only require a passport for registration and do not need a student or work visa, though the monthly fees may be higher than standard plans. The three major telecom providers in Thailand are :AIS Prepaid SIM、Dtac Prepaid SIM、TrueMove Prepaid SIM

Tip: Your local ecommerce sites might also sellThai SIM cardYou can check the seller’s listing page for clearer instructions on how to maintain the SIM card.

Fun Fact :Like the U.S., Thailand has three major telecom providers. The largest is AIS, which holds nearly 50% of the market share. The second largest is TrueMove, with about 30% market share, followed by Dtac, which holds around 20-30%. These three companies dominate Thailand’s telecom industry, similar to how AT&T, Verizon, and T-Mobile operate in the U.S.

Local Thailand Experiencce/Recommendation!:

🍜 Bangkok Food

【Unique Thai Snacks】Exotic Thai Street Food Experience

【Top Buffet】Copper Beyond Buffet at Gaysorn Amarin – A World-Class Culinary Experience

【Classic Thai Seafood】Great Harbour International Buffet Dining Experience at ICONSIAM

【Michelin Restaurants】20 Must-Visit Michelin Dining Experiences in Bangkok | 2024 updated

【Classic Thai Seafood】Discover Thailand’s Best Coastal Eateries

【Michelin Thai Buffet】Market Café by Khao at Hyatt Regency Bangkok Sukhumvit – Enjoy $90 Worth of Dishes for $24

【Thai Local Delicacies】Experience Thailand's street food stalls! How to say "not spicy" in Thai?

【Bangkok's Best-Kept Sweet】Top 10 Hidden Gem Dessert Cafes in Bangkok

🚆 Bangkok Transportation Tickets and Passes

【Getting Around】Common ways to navigate Bangkok’s city traffic.

【Airport Transfers】Private car transfers from BKK/DMK airports to Bangkok city hotels.

【Bangkok Ride-Hailing】Comparing Thai taxis vs. Grab—which is more cost-effective?

【First-Time Visiting Thailand?】Get One-day Bangkok sightseeing passes

【Taking the Train in Bangkok】Experiencing Thailand’s railways—waiting for trains on the tracks!

⛱️ Skip the Planning! Join a Local Day Tour & See More Attractions.

【Must-See for 1st-Timers】Floating Market Day Tour from Bangkok: Damnoen Saduak, Maeklong Market & Amphawa Fireflies Cruise

【Thai Costume Experience】One Day - SENSE OF THAI Costume Rental Experience

【20K+ Rave Reviews】Let’s Relax Spa – Bangkok’s Award-Winning Massage & Spa

【Complete Thailand Golf Guide】A Full Overview of Thailand’s Golf Courses

【Bangkok Golf】Introduction to Bangkok Golf Courses, Prices, and Booking

【Pattaya Golf】Pattaya Golf Courses: Top Picks, Prices, Rankings & Booking Guide

【Chiang Mai Golf】Total Guide to Chiang Mai Golf Courses, Recommendations, Prices, Rankings, and Booking

【Hua Hin Golf】Hua Hin Golf Guide: Reviews, Best Courses, Prices, and Booking Tips

⚙️Useful Tools for Travelers in Thailand

【Unlimited Internet in Thailand】The most popular eSIM and SIM card options among travelers.

【Luggage Delivery】Luggage Concierge | Same-day delivery from BKK Airport to hotels in Bangkok.

🛏️ Accommodation in Bangkok

【Bangkok Hotels】Recommendations for 20 high-value hotels in Bangkok (including low and high season prices).

😎 About Me

I have been stationed in Thailand for many years (seeAbout me), speak Thai, and serve as your local insider guide. Feel free to join my Facebook Page:LiangYu in Thailand - Eight Years as an Expat in Thailand, Firsthand Insights into Thai Life, where we can share experiences about work, life, travel, and business in Thailand.

☎ Reservation Services for Thai Restaurants, Hotels, and Golf

Most reservations for Thai restaurants, itineraries, and vacation apartments in Thailand require a local Thai bank account for booking. (Popular cafes in Thailand like the Maldives-themed Bubble in the Forest Cafe and many unique accommodations outside major cities, such as those in the Pilok area of Kanchanaburi, often do not have online booking and payment mechanisms.) If you needassistance on booking or order thai goods, please reach out on :Facebook